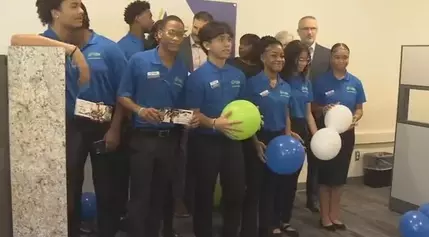

In a groundbreaking move, Riverside High School in Jacksonville, Florida, has partnered with VyStar Credit Union to establish a student-run banking branch on campus. This innovative initiative aims to provide students with hands-on experience in the financial industry, equipping them with essential skills for their future careers and personal financial management.

Unlocking Financial Literacy and Real-World Experience

Bridging the Gap Between Classroom and Career

The VyStar Academy of Business at Riverside High School is more than just a banking branch; it's a transformative platform that empowers students to gain practical, real-time experience in the financial sector. By working as paid interns, these young individuals are not only learning the intricacies of banking operations but also developing a diverse set of skills that will serve them well in any career path they choose.From mastering the art of account opening and transaction processing to honing their problem-solving and communication abilities, the student workers are gaining a comprehensive understanding of the financial industry. This hands-on approach not only enhances their employability but also instills a sense of financial responsibility and decision-making that will benefit them throughout their lives.Empowering the Next Generation of Financial Stewards

The VyStar Academy of Business is more than just a training ground for future bankers; it's a platform that empowers students to take control of their financial futures. By providing them with the tools and knowledge to navigate the complexities of personal finance, the program equips these young individuals with the confidence and skills to make informed decisions, avoid financial pitfalls, and build a secure financial foundation."Some of our students are providing or assisting and providing financial needs in their own household," says Kevin Brown, the school program advisor with VyStar. "Being able to work with VyStar Credit Union and from that, go to college, build a career."This holistic approach to financial education not only benefits the students but also has the potential to create a ripple effect, as these young financial stewards share their knowledge and experiences with their families and communities, ultimately contributing to a more financially literate and empowered society.A Collaborative Effort for Student Success

The VyStar Academy of Business is the result of a strategic partnership between Riverside High School and VyStar Credit Union, a testament to the power of collaboration in driving educational innovation. By combining the resources and expertise of both institutions, this program offers students a unique opportunity to gain hands-on experience and develop the skills necessary to thrive in the financial industry and beyond."The better prepared you are to handle your finances, the less pressure there is when you navigate that," explains Michael Rathjen, the Vice President of School Programs with VyStar. "Having that financial education early on can help them prepare for their future instead of having to repair their past."This collaborative approach not only benefits the students but also strengthens the bond between the school and the community, fostering a shared commitment to empowering the next generation of financial leaders.A Ripple Effect of Opportunity

The VyStar Academy of Business at Riverside High School is not a standalone initiative; it is part of a growing network of student-run banking branches established by VyStar Credit Union across Duval County. This expansion reflects the organization's commitment to providing educational and career-building opportunities to students throughout the region."The Academy of Business through VyStar has 18 other branches just like this in different schools," says Rathjen, underscoring the far-reaching impact of this program.As more schools and communities embrace this innovative model, the potential for transformative change grows exponentially. By equipping students with the skills and knowledge to navigate the financial landscape, these student-run banking branches have the power to create a generation of financially literate and empowered individuals, poised to shape the future of their communities and the broader economy.New

15.4K

771

177

Entertainment

46.4K

1.9K

686

Fashion

38.3K

1.9K

784

Fashion

17.4K

1K

385

Finance

9.8K

293

105

Finance

11K

1.1K

341

Finance